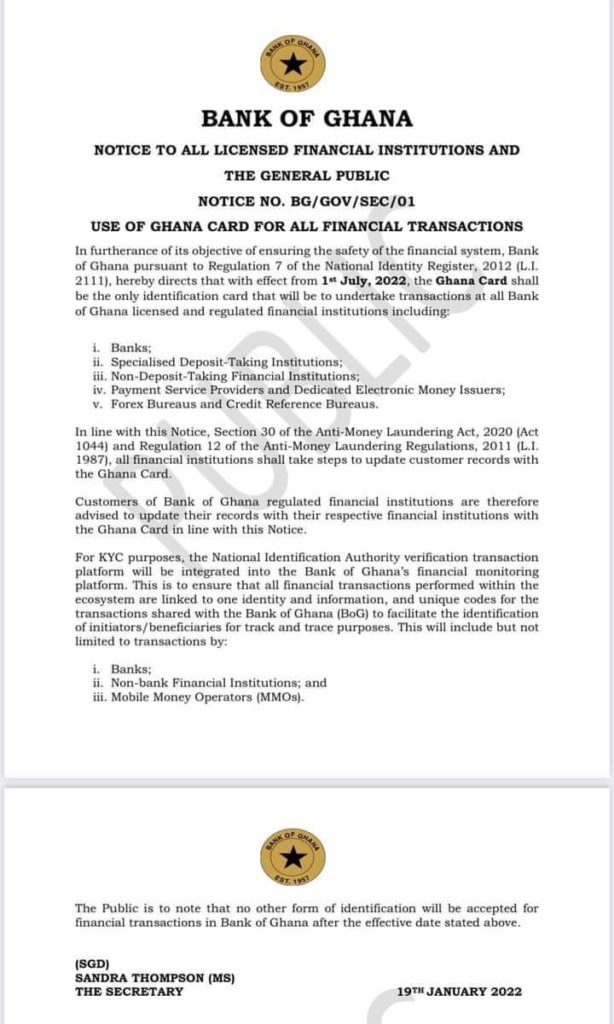

The Bank of Ghana has announced that effective from July 1, 2022 the Ghana Card shall be the only identification card that will be used to undertake at all Bank of Ghana licensed and financial institutions.

This is pursuant to Regulation 7 of the National Identity Register 2021 (L.I 2111) in furtherance of the Central Bank’s objective of ensuring the safety of the financial system.

Financial institutions affected by this directive include all Bank of Ghana licensed banks, specialized deposit-taking institutions, non-deposit taking financial institutions, payment service providers and dedicated electronic money issuers, forex bureaus and credit reference bureaus.

The Central Bank has also directed these financial institutions to take steps to update customer records with the Ghana Card.

This it says is pursuant to Section 30 of the Anti-Money Laundering Act 2020 (Act 1044) and Regulation 12 of the Anti-Money Laundering Regulations, 2011 (L.I 1987).

“Customers of Bank of Ghana regulated financial institutions are therefore advised to update their records with their financial institutions with the Ghana Card in line with this Notice,” it said in a statement.

Meanwhile, the Bank of Ghana has announced that the National Identification Authority verification transaction platform will be integrated into its financial monitoring platform.

“This is to ensure that all financial transactions performed within the ecosystem are linked to one identity and information, and unique codes for the transactions shared with the Bank of Ghana (BoG) to facilitate the identification of initiators/beneficiaries for track and trace purposes,” the Central Bank stated.

Therefore, transactions by banks, non-banks financial institutions and mobile money operators will be affected by this process.

“The Public is to note that no other form of identification will be accepted for financial transactions in Bank of Ghana after the effective date stated above,” the statement concluded.

Source: myjoyonline.com